Meet Zal and our advisors,

who are ready to support you.

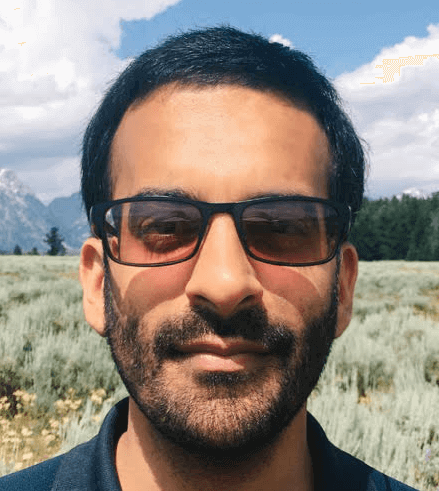

After a decade building software, I joined a16z in 2013 to look for the next breakout consumer or enterprise company. Instead, the most exceptional founders I met pulled me toward a harder frontier: the intersection of computation and the physical sciences.

I went on to help lead a16z’s earliest bio and health investments and supported the firm’s launch of our first Bio Fund in 2015. The following year, I left to start Refactor. Today, I manage 4 funds with $225M in assets under management.

Refactor is built around a simple belief: the most enduring companies are created by founders willing to commercialize real science and scale real systems. Nearly every year, we’ve expanded into a new “hard but not impossible” domain—aerospace, energy, earth systems—where technical execution is the moat. Refactor exists to be a first institutional partner to these founders as they transform R&D into category-defining products and companies.

Previous experience

Behind Refactor

Our advisors offer Refactor founders much needed advice in their areas of expertise.